First Things First

What is wealth?

Imagine you would sell all your belongings and pay back your debts right now. The total amount of money you would obtain after doing so can be understood as your wealth. More precisely, wealth refers to the value of possessions like your house, money in the bank, savings, stocks, and businesses, minus any money owed on these "assets". Such debts include mortgages, loans, and credit card debt. The figure below shows the average wealth of households in Spain broken down into some of these different components.

Figure 1. Average amount of wealth per household in Euros

Source: Weighted data from Encuesta Financiera de las Familias (Banco de España).

The residence of the household is by far the most important source of wealth for private households. Other houses or apartments (for example, second residences or houses rented out to others), businesses, saving funds, stocks, money on the bank and valuables are other common assets. The numbers in Figure 1 represent the average across households, but this picture is to an important extent driven by wealthy households who pull up the average considerably. To illustrate, the average wealth of households in Spain in 2014 was 250.000 euros, but the median wealth of households was 123.000 euros. The median is the household that is exactly in the middle of the distribution of wealth. In other words, half of the Spanish households has more wealth than the median household, and the other half has less wealth. Therefore, the median gives a better picture of what a household "in the middle" looks like. Such a median household normally only has wealth from the main residence plus some money in the bank and still owes an important amount of money in the form of a mortgage. Other forms of wealth are only common among wealthy households.

What are the benefits of owning wealth for households?

In general, wealth is an economic resource that can be used to deal with unexpected financial trouble, to invest, or to help out others. Not all types of wealth are equally accessible when in need. A house has to be sold first (with all related complications), whereas money in the bank can be used instantly for any desired purpose. However, in the long run, there are enormous benefits to all forms of wealth including housing. Not all of these benefits are economical. Even though the statement Mo' Money Mo' Problems might be true on some level, economic resources do reduce stress. There is a large body of research that has shown how wealthy persons enjoy better health, have more stable relationships and live longer. In some countries, wealth might be more important than others. For instance, if the welfare state guarantees a stable income, wealth is less of a necessity than in contexts where it is a real possibility for individuals and households to suddenly have less income available than before.

How about wealth inequality in Spain?

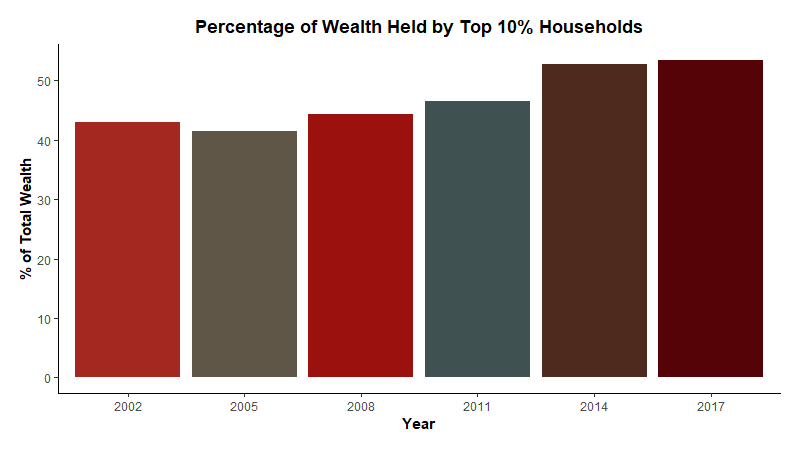

Because wealth matters for many outcomes in life, the question who owns how much wealth is important to understand differences in living standards and opportunities in Spain. Some years ago, academics across the world raised alarms that the distribution of wealth across households has become more and more unequal. Spain is not an exception to this trend. The figure below shows the percentage of total wealth that is owned by the wealthiest 10% of households in Spain; a commonly used indicator of wealth inequality. In fifteen years (2002-2017), the share of wealth owned by the wealthiest 10% of Spanish households rose from 43% to 54%. This means that the wealthiest 10% of households own more wealth than the rest of Spanish households combined (the other 90%).

Figure 2. Percentage of Total Household Wealth in Spain Owned by Wealthiest 10% of Households

Source: Weighted data from Encuesta Financiera de las Familias (Banco de España).

Why is wealth inequality increasing in Spain?

Even though there are some primary suspects, we still know relatively little about the exact reasons why wealth inequality is on the rise. It is the aim of this project to document the sources of increasing wealth inequality in Spain. There are a handful of possibilities that will receive particular attention, but the results of the project will still have to indicate how important each of these turns out to be.

In general, wealth is an economic resource that can be used to deal with unexpected financial trouble, to invest, or to help out others. Not all types of wealth are equally accessible when in need. A house has to be sold first (with all related complications), whereas money in the bank can be used instantly for any desired purpose. However, in the long run, there are enormous benefits to all forms of wealth including housing. Not all of these benefits are economical. Even though the statement Mo' Money Mo' Problems might be true on some level, economic resources do reduce stress. There is a large body of research that has shown how wealthy persons enjoy better health, have more stable relationships and live longer. In some countries, wealth might be more important than others. For instance, if the welfare state guarantees a stable income, wealth is less of a necessity than in contexts where it is a real possibility for individuals and households to suddenly have less income available than before.

A second possibility is that changes in the value of assets are behind increases in wealth inequality. Housing prices have sky-rocketed in parts of the country and this increases the differences in wealth between those who own a home in those areas and those who do not. Increases in housing prices have been concentrated in certain urban areas and less so in poorer areas of big cities and rural areas. This means that not everybody has benefited from increasing housing prices. Besides housing, the context of the last two decades might have enabled the wealthy to invest (in real estate but also stocks or businesses) and to further increase their wealth. How important all these different processes have been in Spain will be investigated in this project.

Who is losing out in terms of wealth and who has been doing relatively well?

In general, it is assumed that those who were well-off have become wealthier over time. But we know little about other characteristics of those that have been gaining wealth over time. For instance, what is the role of birth cohort, education, gender, and social background? These are the type of questions that this project aims to answer over the next years.

Discover more about wealth, its distribution across Spanish households, and the characteristics of individuals living in households with little and plenty of wealth by clicking on one of the buttons below.

A gentle introduction to the concept of wealth

FAQ: What is wealth and is wealth inequality important?

Basic trends in household wealth and its distribution in Spain

Who is gaining wealth, who is falling behind?

Income Education and Social Background

This project is financed by the “la Caixa” Social Research Call 2019 (SR0403-WINEQ)